Are you new to Alberta and eager to make this vibrant province your home? Whether you’re relocating for work, education, or a fresh start, one of the most important aspects of settling down is finding the perfect place to call your own. And that’s where we come in!

Understanding Mortgages in Alberta

Purchasing a home is a significant milestone in anyone’s life, and it’s important to navigate the mortgage landscape with confidence. In Alberta, newcomers have access to a range of mortgage options and incentives to help make their homeownership dreams a reality.

Why Choose Enrich Mortgage?

At Enrich Mortgage Group, we specialize in helping newcomers to Alberta achieve their homeownership dreams. Our team of experienced mortgage professionals is dedicated to guiding you through every step of the process, from pre-approval to closing. We understand the unique challenges newcomers may face and are committed to finding the right mortgage solution for you.

Incentives for First-Time Buyers in Alberta

To Be Eligible for the First-Time Home Buyer Incentive, You Must:

- Be a Canadian citizen, permanent resident or legally authorized to work in Canada.

- Be a first-time home buyer, meaning you have never owned a home. Homeowners who have gone through a divorce or breakdown of a common-law partnership are also eligible, as are those who have not lived in a home that they owned (or that was owned by their spouse o common-law partner) for the last four years.

- Have sufficient funds to make the minimum down payment.

- Be pre-approved for a mortgage that is more than 80% of the property’s value, and thus covered by mortgage default insurance.

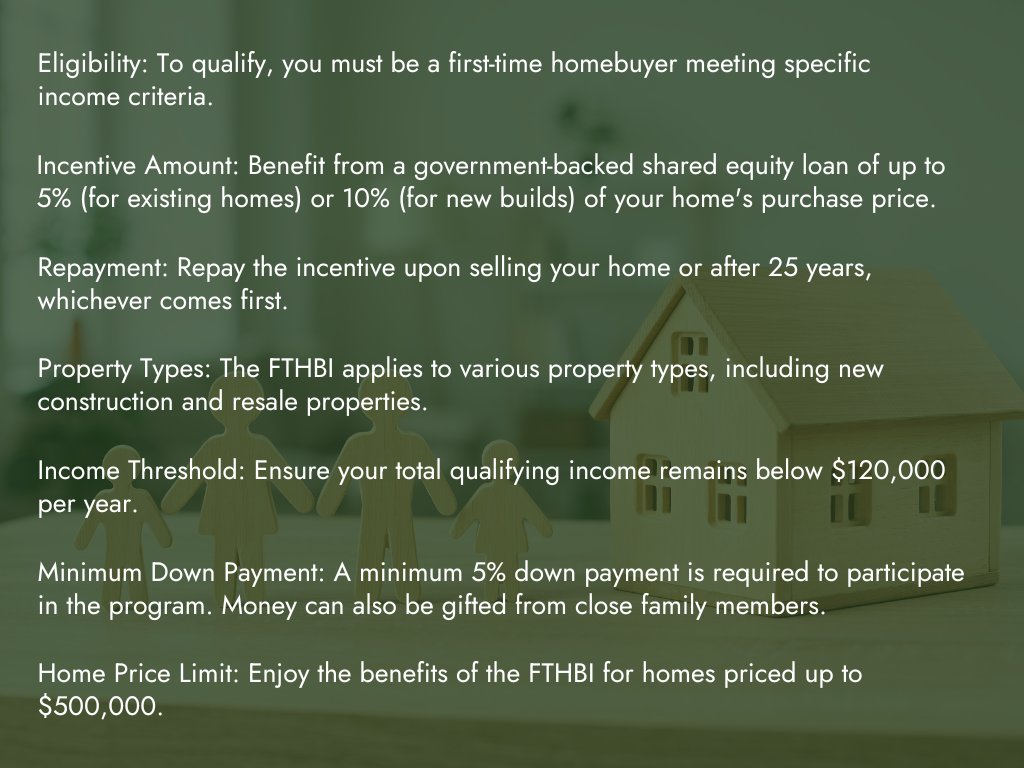

1. The First-Time Home Buyer Incentive (FTHBI): Unlock Affordable Homeownership

The First-Time Home Buyer Incentive (FTHBI) is your key to achieving affordable homeownership in Alberta. Discover essential details:

Unlock the potential of the FTHBI and make your homeownership dreams a reality in Alberta.

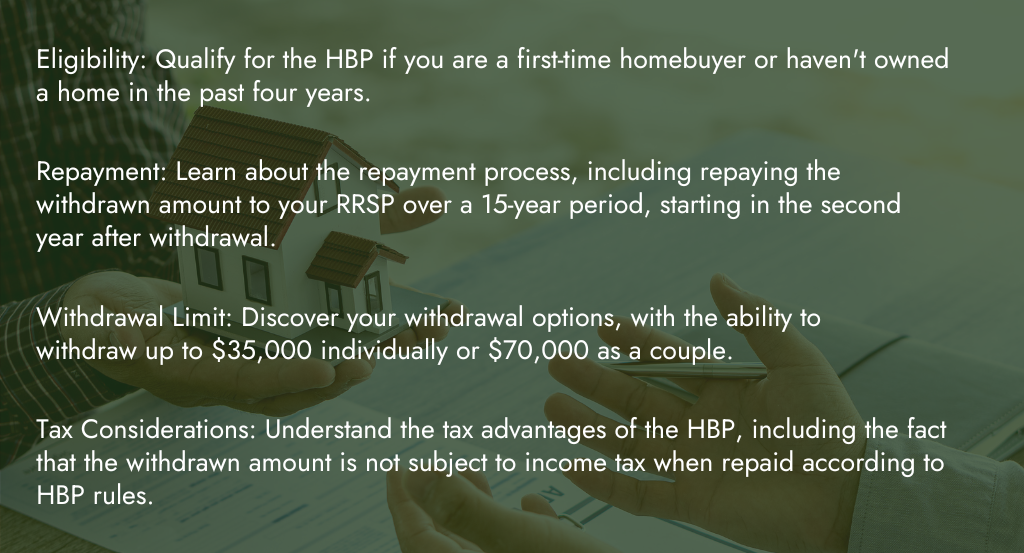

2. Using Your RRSP for Homebuying: Smart Strategies for Home Purchase

Unlocking Your Retirement Savings with RRSP Home Buyers’ Plan (HBP)

The RRSP Home Buyers’ Plan (HBP) empowers you to access your retirement savings strategically for your home purchase. Explore how this plan can benefit you:

Leverage the RRSP Home Buyers’ Plan (HBP) to strategically access your retirement savings for a smart and efficient home purchase.

3. Making the Most of a TFSA for Home Savings

Flexible and Tax-Free Savings

While a Tax-Free Savings Account (TFSA) isn’t designed specifically for homebuying, it can be a powerful tool in your homeownership journey:

- Contributions: You can contribute money annually to your TFSA, and the income earned within the account is tax-free.

- Withdrawals: You can withdraw money at any time, and these withdrawals are tax-free.

- Investment Options: TFSAs can hold various investments, helping your savings grow over time.

- Flexibility: Use your TFSA savings for a down payment when you’re ready to buy.

- Contribution Limits: Stay within your annual and cumulative contribution limits to avoid penalties.

These three key elements—FTHBI, RRSP, and TFSA—can play a pivotal role in your journey to homeownership in Alberta. To get started, consult with one of our mortgage specialists to determine the best approach for your unique situation and goals.

Other Considerations for a Smooth First-Time Home-Buying Experience

Beyond the existing homebuying programs, there are crucial factors to consider to ensure a seamless experience as a first-

time homebuyer.

1. Budgeting Wisely

Before embarking on your home search, it’s essential to gain a comprehensive understanding of your financial capabilities.

This goes beyond the home’s purchase price and extends to additional homeownership costs like property taxes, insurance,

and maintenance. A good rule of thumb is to target housing expenses that do not exceed 30% of your gross monthly income.

2. Saving for the Down Payment

In Alberta, the down payment requirement for home purchases is 5% for the first $500,000 of the purchase price and

10% for amounts exceeding $500,000. A larger down payment not only reduces your borrowing amount but also

lowers your monthly mortgage payments. Furthermore, a down payment of 20% or more eliminates the need for additional mortgage insurance, resulting in more cost savings.

3. Understanding Property Taxes

Property taxes are determined and collected by the municipality in which your property is situated in Alberta. The

exact amount you’ll owe depends on your home’s assessed value and the municipal tax rate. It’s crucial to factor property taxes into your monthly budget to develop a comprehensive home-buying plan.

4. Navigating the Mortgage Process

Comprehending the mortgage process is vital. You’ll need to determine the right mortgage type for your needs, gather

the necessary documentation, and prepare for the mortgage stress test. Collaborating with a skilled mortgage specialist streamlines the process and enhances your chances of securing an optimal mortgage rate.

5. First-Time Buyer Perks

Being a first-time homebuyer in Alberta offers numerous advantages. With adequate preparation and a clear understanding of the process, you can proudly become a homeowner. Several incentive programs for first-time buyers were identified above each of these initiatives will assist you in maximizing your purchasing power. Conduct thorough research to identify the opportunities available to you as a first-time homeowner.

Once you’ve carefully budgeted and feel confident about your down payment, you’re one step closer to realizing your dream of homeownership in Alberta.

ONE OF ENRICH MORTGAGE AGENTS WOULD BE HAPPY TO SPEAK WITH YOU TO BEGIN YOUR MORTGAGE APPROVAL PROCESS.